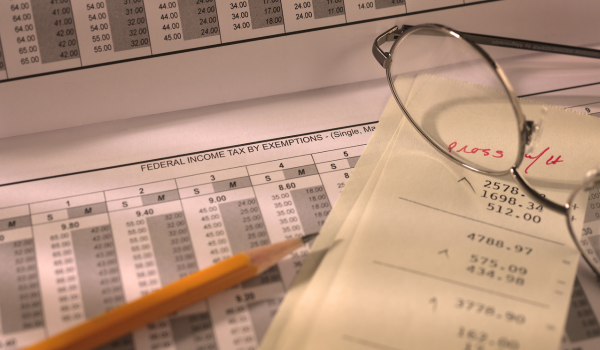

Decoding Paychecks: What's the Difference Between Gross Pay and Net Pay

What is Gross Pay?

Your gross pay is the total amount of money that you earn from your labor before...

This guide will provide you with a comprehensive understanding of the various types of payroll deductions, explaining why each type is significant. Furthermore, our guide will help you distinguish between mandatory and voluntary deductions and pre-tax and post-tax deductions.

A payroll deduction is an amount that has been withheld from an employee's earnings for paying taxes and benefits. Income taxes, wage garnishments, 401(k) contributions, and child support payments are all examples of payroll deductions that are taken out of your employee's paycheck, either pre-tax or post-tax, depending on the type of deduction.

Some deductions are voluntary, like 401(k) contributions, while others (like taxes) are required by law. Businesses that do not withhold the required deductions may be held liable for paying the deductions themselves.

There are multiple types of payroll deductions, including mandatory deductions, voluntary deductions, pre-tax and post-tax deductions. It's important for your business' HR professionals to understand the difference and to ensure proper compliance with each type of deduction. Working with a dedicated payroll provider can help.

Mandatory deductions are deductions that the government requires to pay for taxes and public services. The federal income tax, state income tax, and federal insurance contribution tax (FICA) for Medicare and Social Security are all examples of mandatory deductions.

These deductions are not required to be withheld if you're working with independent contractors because they are required to pay their own taxes. Knowing the difference between an independent contractor and an employee is important and can help determine whether you're properly withholding deductions.

Voluntary deductions are deductions that are not required by law, but are instead optional based on benefits to your employees. An example of a voluntary deduction is an amount that is contributed to a retirement plan. Another example is a deduction that pays for health insurance. While these deductions are not required, if your business deducts an amount from your employee's paycheck, your employee should be aware and give permission.

Some deductions are taken before taxes are applied, lowering your employee's tax liability. An example of a pre-tax deduction is a deduction made toward a health insurance plan or a retirement plan. Following all employment and tax regulations is important when making pre-tax deductions. If you're unsure which types of deductions can be made pre-tax, consult a payroll expert to learn more.

Some types of deductions are made after taxes are applied. Examples of post-tax deductions include wage garnishments and charitable donations made as automatic paycheck withdrawals. These deductions are made after taxes are applied because it is legally appropriate for the employee to pay taxes on that money before the deduction hits.

Calculating payroll deductions accurately is essential for any business to ensure compliance and accurate payroll processing. To calculate payroll deductions, you must first identify the mandatory and voluntary deductions applicable to each employee.

The calculation starts with the employee's gross pay and then subtracts pre-tax deductions to arrive at the taxable income. Taxes are calculated based on this amount.

Following the tax deductions, any post-tax deductions are subtracted to determine the net pay. It's vital to stay updated on tax rates and deduction limits, as these can change annually. For complex scenarios or to ensure accuracy, consider consulting a payroll expert, like Exact Payroll.

Exact Payroll provides tailored solutions to meet your business needs. Our team of experts is well-versed in all aspects of payroll and HR, ensuring your business stays compliant while optimizing your payroll process. Let us help you streamline your payroll process so you can focus on running your business. Contact Exact Payroll today for guidance on payroll deductions and comprehensive payroll and HR support.

Your gross pay is the total amount of money that you earn from your labor before...

On July 4, 2025, new federal tax legislation was signed into law. Informally referred to as the...

4 mins

Understanding how small business taxes work requires care and precision for companies operating in...

6 mins

Exact Payroll Inc

3993 Huntingdon Pike Suite 110

Huntingdon Valley, PA 19006

Mon - Fri: 8:30AM - 5:00PM

Company

Subscribe to Newsletter